The Firm comprises of a team of worthy practitioners who represent a coalition of specialized skills that is geared to offer 1) Audit & Assurance, 2) Accounting & CFO Advisory and 3) Tax & Regulatory services and who are well versed with industry specific requirements and the corresponding laws prevailing in the country.

We consider every member of the organization as a family member and the entire team as one united happy family. Our people related decisions are not only driven by our mind but also driven by our heart.

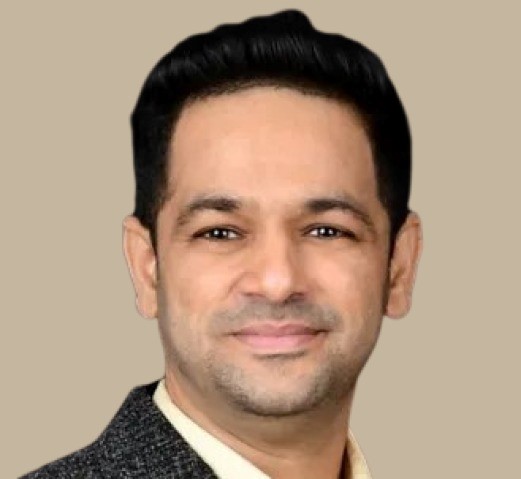

Deepak Rao : Founder

Senior Advisor: Cladus Consultech LLP

Deepak Rao & Co was founded by CA Deepak Rao (the ‘Founder’, or ‘He’ or ‘Deepak’) who is a Chartered Accountant, a Fellow member of ICAI (FCA) and a Master of Commerce degree holder with over two decades of professional services experience.

Deepak’s experience includes incubating professional service practices, leading & managing large regional practices, creating careers for many people across various roles, working in international and multicultural environments having worked in the UK for 6 years, the Middle East for 2 years and in India with large global network of professional services firms.

He has led and managed several complex Audit & Assurance and Accounting Advisory engagements, in India and internationally across diverse market segments such as Technology, Financial Services, Infrastructure, Industrial, Media, Entertainment and Consumer Products. He also has experience in working with many dynamic start-ups through their business life cycle. He is also the Senior Advisor to Cladus Consulteh LLO (the profile of which can be found in https://cladus.in)

Deepak’s experience on select key projects include:

● Led the audits of many start ups in the tech spacer, large multinational investment banks, retail banks, and insurance companies in India and the UK. This included managing the audit of the largest retail bank in the UK.

● Handled IFRS transition of a large multinational UK based insurance company.

● Led the audits of many auto captive finance & Non Banking Financial Services Companies in India.

● Led the audit of one of the largest multinational ATM manufacturer and service provider.

● Led the audit of Indian subsidiary of world’s largest beverage maker.

● Spearheaded the successful IPO project of a Small Finance Bank as their auditor.

Kshitij Raj : Growth Partner

Management & Technology

Kshitij is a chartered accountant, an experienced finance professional and a technology enthusiast. His experience includes working with multinational accounting firms. He is also an entrepreneur with keen interest in online education platforms, web designing, search engine optimisation, digital marketing and CA tech products. He is a solution oriented professional and adds significant value to the family by harnessing his strong managerial, leadership, people coaching and project management skills.

Yashesh Ashar : Senior Advisor

Transactions, Tax & Regulatory

Yashesh is a Partner of Illume Advisory (www.illumeadvisory.in), a Mumbai based Transactions Advisory, M&A Advisory and CFO Advisory services firm. Yashesh has over 14 years of tax and regulatory experience as well as in M&A, group restructuring, inbound and outbound investment structuring, transaction structuring, due diligence, fund and structuring, tax modelling and negotiations, wealth and estate planning. Prior to this, he was a part of various Big 4 firms PwC and EY. Yashesh is a fellow member of the Institute of Chartered Accountants of India and a Bachelor of Commerce from the Mumbai University. Yashesh has authored / co-authored various articles on tax, regulatory and transaction aspects. Yashesh is also regularly invited by leading business dailies for contributing expert views / articles. Yashesh is a TiE Charter Member and also, strategic advisor with MSME Business Forum.

His skills include: M&A and group reorganizations, Transaction structuring (including PE transactions), Buy side and sell side due diligence, Fund and platform structuring, Regulatory advisory and compliance, Tax advisory, compliance and litigation services.

Yashesh’s experience on select key projects include:

● Acting as a qusai CFO / consultant for AIFs / VCFs handling accounting. Auditing, tax and regulatory compliance MIS, portfolio monitoring, investor relations etc.

● Experience on variety of transactions and M&As ranging from USD 0.5 million to USD 3.5 billion.

●Experience on structuring and implementations of domestic & offshore funds with AUM of USD 5 million to USD 1.5 billion.

●End to end transaction implementation from term sheet stage through valuation, diligence, structuring, negotiations, documentations, closing and post-acquisition integration..

●Advising various private equity firms – offshore as well as domestic on structuring the fund as well as management structures.

● Experience in setting up alternative asset platforms across the entire spectrum.

●Advised various financial services entities in formulating their entry strategy into India / structuring platforms in the financial services and private equity space

● Advising HNIs / business houses in wealth and succession planning avenues as well as on immigration / migration abroad.

● Advising various start-up entrepreneurs fund raise, ESOPs, exits / listing opportunities.

● Fund raising for start-ups including preparation of pitch deck, financial modelling, valuation & advisory.

Raashi Shah : Senior Advisor

Transactions, Tax & Regulatory

Raashi is a Partner of Illume Advisory (www.illumeadvisory.in), a Mumbai based Transactions Advisory, M&A Advisory and CFO Advisory services firm. Raashi has over 10 years of tax and regulatory experience as well as in international tax, tax structuring / M&A, due diligence, financial modelling wealth and estate planning, legal drafting and documentation, company law and FEMA matters. Raashi is a member of the Institute of Chartered Accountants of India, Bachelor of Law and MBA in finance. Raashi has authored / co-authored various articles on tax, regulatory and transaction aspects.

Her skills include: Tax advisory and structuring, Legal drafting and documentations, Tax and GST compliance and representation, Regulatory advisory and compliance (FEMA, Company laws), Tax advisory, compliance and litigation services and Start-up advisory & fund raising.

Raashis’s experience on select key projects include:

● Acting as a qusai CFO / consultant for AIFs / VCFs handling accounting. Auditing, tax and regulatory compliance MIS, portfolio monitoring, investor relations etc..

● End to end implementation of various M&A transactions including slump sale, demerger / merger, preparation of schemes, briefing senior counsel etc..

● Handling tax and GST compliances and representation for various corporates and start-ups.

● End to end transaction implementation from term sheet stage through valuation, diligence, structuring, negotiations, documentations, closing.

● Drafting of various legal documentation for contracts, M&A transactions, SHA, SPA etc.

● Advising various start-up entrepreneurs fund raise, ESOPs, exits / listing opportunities.

● Advising HNIs / business houses in wealth and succession planning avenues as well as on immigration / migration abroad.

● Advising on Crypto taxation as well as setting up crypto NFT platforms in Singapore / Dubai.

● Advising on setting up domestic and offshore fund structures for investments in India.

● Fund raising for start-ups including preparation of pitch deck, financial modelling, valuation & advisory.

Neha Kapur: Senior Advisor

Risk Advisory & Internal Audit

Neha is an independent Risk Management and Internal Audit Professional, based out of Bengaluru. Neha has over 15 years experience in risk consulting environment at PricewaterhouseCoopers, BDO, Axis Risk Consulting Services Pvt. Ltd. and freelancing assignments. Neha has cleared exams for Certification in Internal Audit (CIA ®), Control Self-Assessment (CCSA®) from The Institute of Internal Auditors, Florida and Certified Information Systems Auditor (CISA). She is from Commerce background and she is a MBA from Fore School of Management.

Her skills include: Risk based internal audits, preparation of SOPs, Process design reviews, Risk assessment, and Internal financial controls.

- Neha’s experience on select key projects include:

● Manage large Internal Audit and Risk engagements across portfolio of clients. Scheduling engagements; Preparation of audit strategy and work plans; Monitoring progress of assignment to ensure adherence to time budgets; Preparation of MIS and Resource allocation. - ● Build strong network and relationships at clients (Board / Audit committee / Management)

- ● Leading, nurturing and managing team.

- ● Work with Advisory Leadership on firm’s strategic priorities and practice initiatives.

- ● Develop and Profitably Grow Risk Advisory Services (RAS) practice in Bangalore across various sectors. Business planning, business development, project execution, billing and collections.

- ● Marketing initiative with prospective clients; preparation of Approach Paper and Proposals.

- ● Part of the setting up of Knowledge management function for RAS in PwC.

- ● As freelancer worked with Swiggy, helping them define and review processes for Procurement, Inventory and defining process related smart sheets.

- ● As part of JBR with PwC, worked on IFC reviews.

Suraj Malik: Senior Advisor

M&A and Family Office

Suraj is the Founder & Managing Partner of Legacy Growth (www.legacygrowth.com). Suraj is a Chartered Accountant and a M&A expert with over two decades of experience in structuring deals, cross-border transactions, corporate restructuring and alternate investments. He also works extensively with family businesses on their succession, governance, and strategic growth matters. He is a prolific speaker and actively addresses audiences across national and international forums. He has also been recognised among the Top 40 Alternate Investment professionals in India.

Chethan Bhat: Senior Advisor

M&A Tax

Chethan is a Partner of Legacy Growth (www.legacygrowth.com). Chethan is a Chartered Accountant and has over 15 years of experience in Mergers and Acquisitions, having been with top-tier firms like Deloitte and PWC. He’s led numerous M&A transactions across sectors like Tech and Education, excelling in structuring, negotiations, and documentation. With a proven record overseeing mergers and corporate restructurings across NCLTs, his expertise also spans GST, Exchange control regulations, and intricate Company law matters. Additionally, Chethan is a notable contributor to prominent tax journals.

Shankar: Growth Partner

Strategic CFO Services

Shankar is a Co-Founder and Director of QuantAscend (www.quantascend.com). Shankar is a Chartered Accountant having more than 15 years of experience in International Tax matters, CFO consulting and regulatory matters including FEMA and RBI, working with KPMG, HP, Amazon and Herbalife India. Shankar has expertise in cross border tax planning, providing strategic business ideas, advising on financial matters, managing tax litigation and representing before regulatory authorities. He was also part of the large mergers and acquisitions, managing tax matters upto Supreme Court along with Senior Counsels.

Pradeep: Growth Partner

Strategic CFO Services

Pradeep is a Co-Founder and Director of QuantAscend (www.quantascend.com). Pradeep, an alumnus of UCLA Anderson School of Business, comes with 16 years of Banking and Finance Industry experience working with HDFC Bank, ICICI, Anand Rathi & ABN Amro. His varied experience includes Equity, Debt & Alternate Investment management, Trade & Forex, Corporate, SME & Retail Banking. He has worked closely with many Fortune 500 companies to set up their India corporate finance ops. His specialization includes corporate finance, investment management for HNIs, treasury advisory, debt syndication, GTM and strategy.

Anil Birajdar: Growth Partner

Cross Border Structuring & Fund Set Up

Anil Birajdar is the Managing Director & Co Founder of Bheeshma Advisory (www.bheeshmadvisory.com). Anil is a dynamic individual with a 15 plus years of global experience in Cross Border Structuring, Fund Set up & Estate Planning. He has travelled across Europe, Asia, Africa and North and South America during his career, and has strategized and implemented several client centric structures across the globe. He acts as a board member of several Multinational Companies.

Anil has many layers of experience in a wide range of international structuring across various jurisdictions; and has led teams comprising different nationalities in various projects. He feels at home in diverse cultural settings and also infuses his team members with a vibrant and cohesive work culture.

Few of the recent successful deal closures are Setting up a fund in Cayman Islands which Invested 100 Million USD in South Korea, Set up a New Zealand Foreign Grantor Trust for HNI family based out of Africa, Registered 3 FPI (Foreign Portfolio Investments) to trade on the listed securities in India .

Anil comes across as a highly perceptive individual with a penchant for absorbing fresh knowledge from different sources, and is always up to date with the latest developments both within his work domain and outside it. He loves reading, travelling, and meeting new people, and possesses excellent inter-personal skills and networking ability which has earned him valuable friendships across the globe.

Management & Leadership

The Management & Leadership team of the Firm consists talented Chartered Accountants with experience across diverse market segments such as Technology, Financial Services, Infrastructure, Industrial, Media, Entertainment and Consumer Products.

This team consists of empowered people from diverse perspectives. Diversity is about differences and this team thinks broadly about differences, such as gender, language, working & thinking style, religious & cultural background, sexual orientation, experiences, and career paths. This team imbibes and promotes an inclusive culture which is about leveraging differences to live the culture where all people are; respected, valued, have a sense of belonging, empowered, socially responsible, have integrity, ethics & morals in their DNA, inspired to contribute their best and given an opportunity to cherish various cycles of professional experience.

Trainees

The Firm considers that it has a very important responsibility to train, professionally develop, guide, coach and mentor future leaders in the professional services discipline in which it operates.

As part of fulfilling this responsibility, the Firm integrates in it’s team; talented, dedicated and hardworking trainees especially in the field of accountancy and aspiring Chartered Accountants.

These Trainees are empowered to pursue their passion at work, given various cycles of learning experience, given a career path, upskilled in core professional competencies, respected and valued.

The trainees are nurtured in such a way that they acquire the knowledge and skill sets necessary for them to fulfil their academic objectives as well as to become extraordinary professionals, future leaders, and builders of the Great India tale.